The global smartphone market returned to growth in 2024 after two consecutive years of annual declines, according to preliminary results from Counterpoint Research’s Market Pulse.

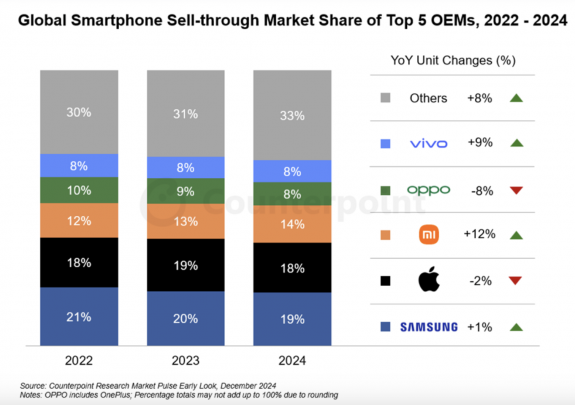

Samsung continued to lead the market in 2024, led by strong demand for its S24 series and A-series product lines. The S24 series, the first phone positioned as an AI device, outperformed its predecessors and was received especially well in Western Europe and the USA.

Apple, with an 18% share took the #2 spot. Apple’s iPhone 16 series was met with a mixed response, partly due to a lack of availability of Apple Intelligence at launch. However, Apple continued to grow strongly in its non-core markets like Latin America, Africa and Asia-Pacific-Others.

Xiaomi grew fastest among the top five brands in 2024, helped by its portfolio realignment, premium push and aggressive expansion activities.

OPPO came in fourth, with a YoY decline, but it ended the year with stronger momentum. vivo rounded off the top five, led by strong performance in India and China, where it ended the year as the top-ranked OEM. The top 5 remained the same as in 2023 but lost some share to aggressive competition from Huawei, HONOR and Motorola, the fastest-growing OEMs among all the top 10 brands.

Global smartphone sales grew four per cent YoY in 2024, as consumer sentiment fared better than in previous years following macroeconomic improvements. Smartphone sales in 2023 were the lowest in a decade.

Xiaomi grew fastest among the top five brands in 2024, helped by its portfolio realignment, premium push and aggressive expansion activities.

OPPO came in fourth, with a YoY decline, but it ended the year with stronger momentum. vivo rounded off the top five, led by strong performance in India and China, where it ended the year as the top-ranked OEM.

The top 5 remained the same as in 2023 but lost some share to aggressive competition from Huawei, HONOR and Motorola, the fastest-growing OEMs among all the top 10 brands.

Research Director Tarun Pathak said, “2024 was a year of recovery and normalization after a difficult 2023. Smartphones continue to be an essential product, pivotal to people’s daily lives, and as macroeconomic pressures softened, the market started showing signs of recovery from Q4 2023 and has now grown for five consecutive quarters. Almost all markets showed growth, led by Europe, China and Latin America.”