Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

UK mobile operators and retailers are likely to face renewed margin pressure in 2026 as a global shortage of memory chips drives up handset costs, limits specification upgrades and weakens traditional upgrade incentives.

IDC has warned that the semiconductor industry is undergoing a structural shift, with memory manufacturing capacity being redirected away from smartphones towards AI data centres.

The resulting squeeze on DRAM (Dynamic Random Access Memory) and NAND flash memory supply is expected to persist well into 2027, pushing up component prices and altering OEM pricing strategies.

For the UK telecoms channel, the impact is expected to be felt most acutely in contract pricing, promotional mechanics and upgrade behaviour, rather than in dramatic headline price rises.

IDC say, the memory shortage is not a short-term disruption but a structural change in the global supply chain. For UK operators and retailers planning their 2026 handset strategies, margin discipline rather than volume growth may become the defining challenge.

UK handset margins are already under strain following several years of inflation, higher energy and logistics costs, and a slowdown in consumer upgrades. IDC believes rising memory prices will push up OEM wholesale prices in 2026, particularly in the £200–£400 Android segment that underpins much of the UK contract market.

Memory accounts for up to 20 per cent of the bill of materials in a mid-range smartphone. As costs rise, OEMs are expected to prioritise margin protection, passing more of that pressure down the supply chain.

For UK operators, this raises fresh challenges around handset subsidies. Absorbing higher device costs without increasing monthly contract prices will become increasingly difficult, especially on entry-level and mid-tier tariffs where margins are already tight. Any increase in device pricing risks pushing customers into higher monthly payments at a time when affordability is under greater scrutiny.

Retailers face similar constraints. With less room to discount devices upfront, particularly outside major launch windows, profitability on contract and PAYG handsets could come under further pressure.

The UK market has become increasingly dependent on perceived value to drive upgrades, with memory upgrades and storage boosts often used as a simple marketing hook. IDC expects this lever to weaken in 2026, as OEMs rein in specification increases to manage costs.

Consumers upgrading from older handsets may see fewer tangible improvements at familiar price points, particularly in RAM and storage. This risks further lengthening already extended upgrade cycles, which in the UK are now commonly stretching beyond 36 months for many customers.

Operators may struggle to justify higher monthly contract prices without clear device differentiation, increasing reliance on airtime discounts, loyalty incentives or longer contract terms to retain customers.

One of the clearest risks highlighted by IDC is an acceleration in SIM-only migration. As contract prices rise and handset promotions become less compelling, more UK consumers may choose to hold onto existing devices and switch to SIM-only plans.

This trend is already well established in the UK, with SIM-only accounting for a growing share of net additions across all major networks. Higher handset costs and flatter specification gains could reinforce this behaviour, reducing device attach rates and lowering the overall value of contract acquisitions.

For retailers, particularly those reliant on device-led footfall and commission, a further shift towards SIM-only could weaken sales volumes and increase competition on airtime pricing alone.

IDC expects the impact of the memory shortage to be most severe in the mid-range Android segment, which plays a critical role in UK operator portfolios. Vendors such as Xiaomi, Oppo, Vivo, Realme, TCL and Honor, which compete aggressively in the £200–£400 range, operate on thin margins and rely heavily on rapid spec progression to stand out.

If these vendors are forced to raise prices or hold specifications flat, operators and retailers may see reduced differentiation between models and fewer compelling upgrade propositions at key price points.

Apple and Samsung are better insulated due to long-term supply agreements and scale, but even here IDC expects caution. Flagship devices launched in 2026 are unlikely to see major memory upgrades, while price erosion on older models may slow, limiting opportunities for UK retailers to drive volume through late-cycle discounting.

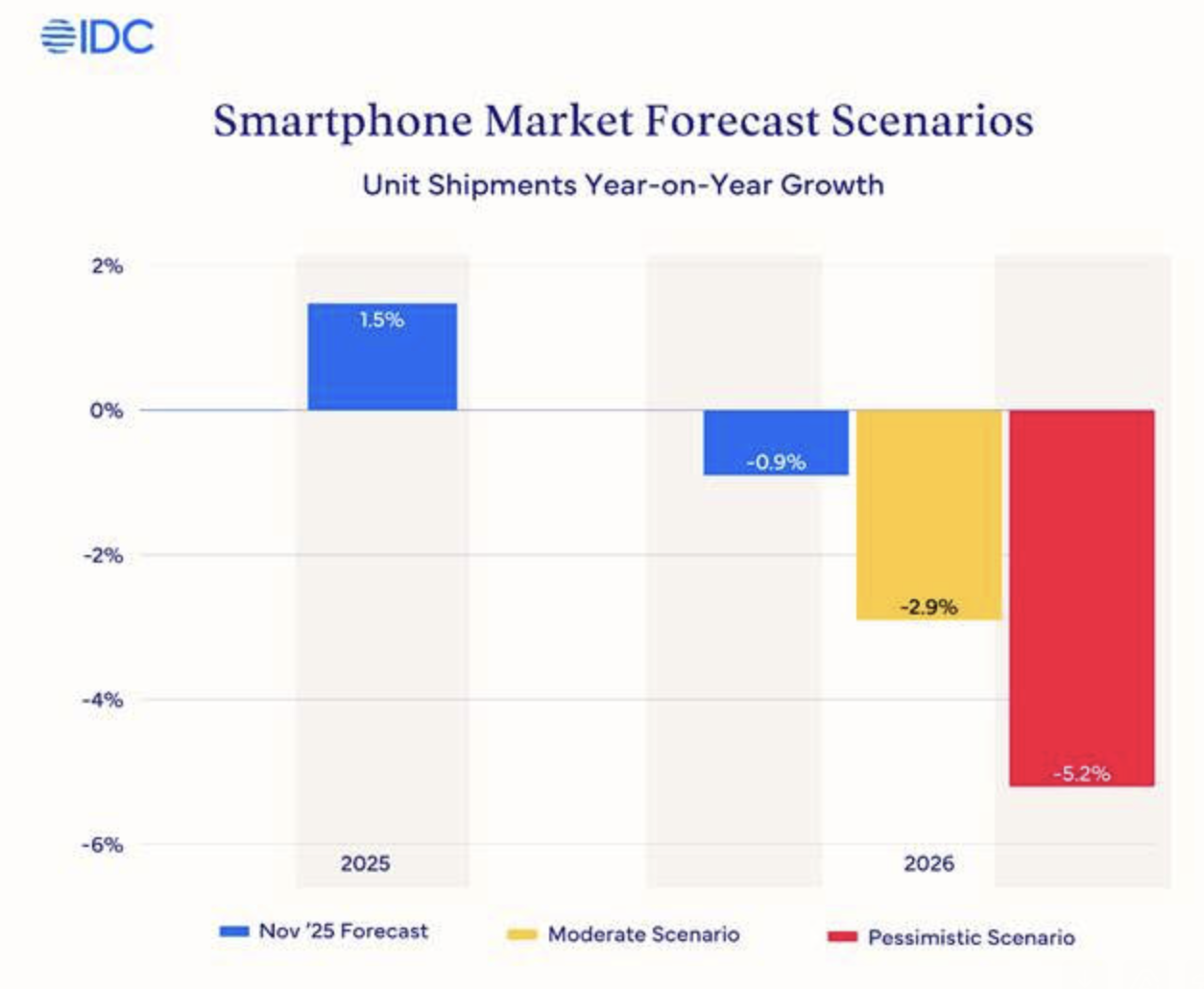

IDC has not yet revised its official UK smartphone forecasts, but it has outlined downside risks if memory supply constraints worsen. For the UK telecoms channel, the direction of travel is already clear.

Higher wholesale costs, weaker upgrade incentives and a continued shift towards SIM-only threaten to squeeze margins across the value chain. Operators and retailers may need to place greater emphasis on trade-in, financing, insurance and value-added services to maintain profitability, rather than relying on handset-led growth.