Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

The global tablet market declined 9.6 per cent year-on-year for the first quarter of 2020 according to IDC.

IDC revealed that only 8.8 million units were shipped as the big vendors struggled in the first quarter.

This was despite an increase in commercial demand for tablets, as more people have worked from home.

But a halt in manufacturing in China due to the coronavirus meant that it was difficult to meet consumer demand.

IDC research analyst Helena Ferreira said: “The factory shutdown in China brought manufacturing and logistical supply chain problems to the market, meaning a spike in demand could not be met

“Although the first quarter of the year is generally not marked by strong seasonality in education, some Android vendors, such as Samsung and Lenovo, as well as Apple, faced increased demand in this segment.”

Ferreira adds that the impacts on the supply chain constraints will create “backlogs for the coming quarters.”

The overall performance in Western Europe was strong, with a decline of just 5.2 per cent, compared to the Middle East and Africa which dropped 16 per cent.

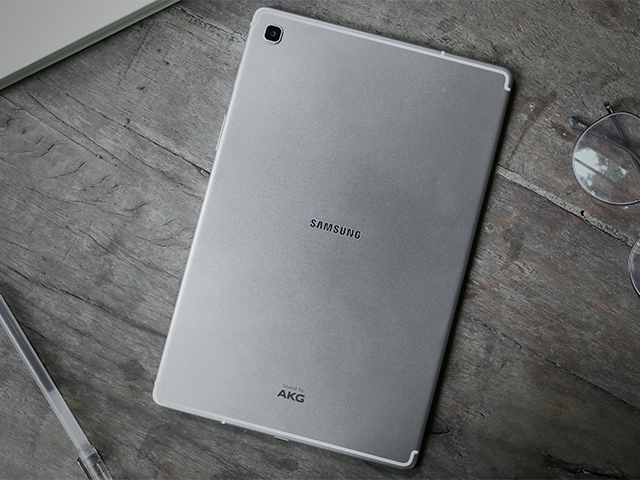

Samsung pipped Apple for top spot in the quarter, with Huawei in third.

Samsung shipped 2.16 million units, while Apple shipped 2.1 and Huawei sold just over one million units.

However all three vendors experienced YoY declines, with Apple the worst hit at 9.3 per cent. For the same quarter last year Apple shipped over 2.3 million units.

Lenovo (fourth) and Microsoft (fifth) however grew 4.2pc and 19.6pc YoY.

IDC expects the market to continue to struggle, and forecast the overall market to drop 8.8pc during the 2020 calendar year.

Although the market will benefit from the lockdowns imposed in Q2, but not to the same extent as PC sales, says IDC.

IDC also tip the market to rebound next year, with three per cent YoY growth in the EMEA region, driven by the Western European market.

IDC Western Europe personal computing devices research manager Daniel Goncalves added:

“Despite the bleak outlook for 2020, this period of confinement brought to light the urgency of accelerating digital transformation, which can have a positive impact on tablet adoption in the commercial segment going forward.

”In the short term for tablets, this is likely to push forward digitisation projects in education across the region. The category remains important in primary education, and local authorities will certainly want to be ready to address a possible second wave of the pandemic.”