Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical plastic SIM cards are becoming obsolete as more phones have embedded SIMs built into the circuit board, making it easy for consumers to switch networks and plans. Perhaps this is why mobile network operators do not yet seem to be be pushing the benefits to a greater extent.

Embedded SIMs should be heralding a revolution in smartphone design and network product offerings. They enable smaller devices to be designed and might save network operators millions in packaging and distribution costs.

But in the consumer space, this new tech is lacking the impetus it deserves even though eSIMs have been built into smartphones for around three years. eSIMs are blank SIMs built into the circuitry of the device. They enable users to select and activate call plans instantly instead of waiting for a physical SIM to be sent to them, and offer instant connectivity and remote provisioning.

But while millions of eSIMs are being produced for IoT applications in cars, and in industrial and energy equipment – such as smart meters – there has been low take-up of the tech in mobile.

The arrival of phones with eSIM-chip capability promised to turbocharge the market for travel call plans: no longer would it be necessary to purchase plastic SIM cards abroad and deal with activation procedures in foreign languages and currencies.

An eSIM functions the same way as a plastic SIM, except that it is not restricted to a single network. Its use of remote provisioning unlocks it to all networks and allows the user to move freely between different carriers without being locked into a long-term contract.

All a traveller has to do to obtain the best network and service for their destinations is to obtain a device that supports eSIM, install an app, search for their destination, select a plan and enter their credit card details. An email with a QR code is sent and the service is activated by scanning the code.

Several plans can be stored on one eSIM chip and enabled when required. Such SIMs have benefits for manufacturers and networks, as well as travellers, says Gerry O’Prey, CEO of Cloud9 eSIM Technologies – an MVNO operating under the brand eSIM.net that provides eSIM services and 5G connections.

“Phone manufacturers can make thinner phones, as SIM slots are no longer needed,” he says. “eSIM provisioning gives networks advantages because they can change their service quicker without the cost of distributing plastic cards. It’s quite expensive packing up a SIM and shipping it out, and digital services are much better for provisioning.

“A single eSIM can hold around 30 services, so a traveller can have plans for different countries and switch between them but just one can be active.”

Apple’s AppStore reveals around 27 travel eSIM suppliers such as Yesim, Truphone, GigSky, Ubigi, eSIM.net, MobiMatter, Nomad, Extreme, asnd LinksGo. So it has never been so easy and cheap to stay in touch.

Unfortunately, the eSIM travel market has plunged by around 80 per cent because of the COVID-19 pandemic, with O’Prey reckoning that restrictions mean only 20 per cent of people are travelling. But O’Prey, a telecoms entrepreneur with expertise in providing eSIMs and remote SIM provisioning technology to the

M2M and consumer markets, envisages a healthy revival in the eSIM travel sector this summer as lockdowns are lifted.

“We have a global store where you can buy an eSIM service that works anywhere in the world,” he says. “We are also setting up local stores where you can buy local service. eSIMs are the future.”

Truphone has, meanwhile, been involved in selling international call plans for years.

There, chief business development officer Steve Alder says: “The past year kept us all grounded and unable to travel. But it’s important to recognise that travel is just one use case for eSIMs. As we moved to remote working, eSIM afforded many a cheaper and more flexible alternative to WiFi, which can buckle under heavy use.

“Having multiple eSIM plans on one device has a multitude of advantages for personal, business and education use, and where it may be more convenient to segregate communications with a different phone number or identity.”

Sim Local, part of the NetLync organisation that develops eSIM services for networks, provides local network bundles to international travellers and operates retail shops in large hub airports.

Chief operating officer Andrew McClellan confirms that COVID had an impact on eSIM adaption, but that it is inevitable such SIMs will become the prevailing technology in the travel market ahead of wider adoption by domestic users.

“The last year has slowed a lot of things down,” he says. “Travel has suffered more than most, so this has had an impact on eSIM adoption. However, COVID-19 has also prompted a step change in consumer expectations for seamless digital journeys, so our customers are looking for digital options more than ever before.

“As we ease out of lockdowns and limitations on flying between countries are removed, the world’s pent-up demand and ongoing appetite for travel will see a sharp return to the sector in the second half of the year. Alongside this, we expect to see an exponential rise in the demand for eSIMs and a massive opportunity for the operators that can deliver it.”

Devices that support eSIMs have been around for three years. Apple launched the iPhone XS in 2018 with an eSIM and since then, there has been a steady and consistent rise in the number of eSIM-enabled consumer devices, from smartphones to laptops.

With the iPhone SE and iPhone 12 Mini, these are now available to the mid-tier device bracket.

Interestingly, meanwhile, the Motorola Razr was the world’s first smartphone to rely solely on eSIM, and a GSMA Intelligence report predicts that a transition to eSIM-only phones will happen in the next three years.

But even if COVID had not crippled the travel trade, it seems likely that eSIMs would still be shunned by travellers simply because there is such low awareness of what they are and how they work.

At Extreme Connect – part of the Extreme Sports Channel that markets eSIM travel call plans to more adventurous travellers – marketing manager Johnnie Farquhar is confident that the eSIM revolution has arrived and explains why mobile networks are dragging their feet.

“Just like with the launch of any new technology, there is a huge job to be done on educating consumers on exactly what eSIM is and how it works compared to a traditional plastic SIM,” he says.

“Often these educational processes are gradual. However, the extraordinary uptake of Extreme Connect that we have already seen demonstrates just how open consumers are to change and the ease of use; all that you need to do is download the app, select a plan and you’re off.”

Devices that support eSIMs have been around for three years. Apple launched the iPhone XS in 2018 with an eSIM and since then, there has been a steady and consistent rise in the number of eSIM-enabled consumer devices, from smartphones to laptops.

With the iPhone SE and iPhone 12 Mini, these are now available to the mid-tier device bracket.

Interestingly, meanwhile, the Motorola Razr was the world’s first smartphone to rely solely on eSIM, and a GSMA Intelligence report predicts that a transition to eSIM-only phones will happen in the next three years.

But even if COVID had not crippled the travel trade, it seems likely that eSIMs would still be shunned by travellers simply because there is such low awareness of what they are and how they work.

At Extreme Connect – part of the Extreme Sports Channel that markets eSIM travel call plans to more adventurous travellers – marketing manager Johnnie Farquhar is confident that the eSIM revolution has arrived and explains why mobile networks are dragging their feet.

“Just like with the launch of any new technology, there is a huge job to be done on educating consumers on exactly what eSIM is and how it works compared to a traditional plastic SIM,” he says.

“Often these educational processes are gradual. However, the extraordinary uptake of Extreme Connect that we have already seen demonstrates just how open consumers are to change and the ease of use; all that you need to do is download the app, select a plan and you’re off.”

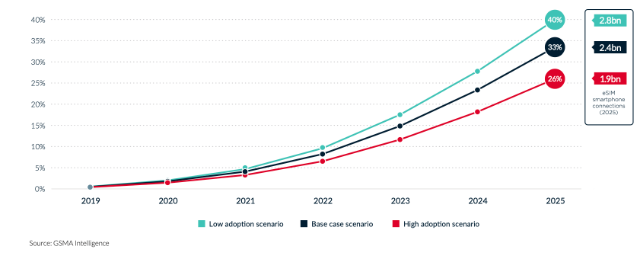

GSMA Intelligence predicts that by 2025 there will be 2.4 billion smartphone connections using eSIMs and that these will become part of day-to-day business, while more than 175 MNOs and MVNOs covering 69 different markets offered eSIMs as part of their service at the end of 2020.

At NetLync, CEO Emir Aboulhosn has been involved with eSIM since the early days of its use in connected devices.

He agrees that eSIM technology is a mystery to most users: “MNOs and OEMs need to do more to communicate and educate consumers on its benefits, thereby building demand and making eSIM part of our everyday lives.

“eSIM momentum has increased rapidly over the last 12 months, with the pandemic only accelerating digital adoption even further. However, with over 800 MNOs and 1500 MVNOs worldwide, there is still a long way to go and certainly an opportunity for many networks that are yet to adopt and offer eSIM to their customers.”

Truphone’s Alder adds: “More focus needs to be put on the benefits rather than the technology itself. Consumers readily embrace digital technology with music streaming, instant messaging and on-demand movies.

They recognise that these make their lives faster, cheaper and easier. We need to communicate the same benefits for the eSIM, which opens up a whole new set of experiences.

“We provisioned our 10-millionth eSIM in March. This is a real proof point to what is happening in the wider industry. We see the market moving past the ‘resistance to change’ moment with eSIM. Having understood the long-term benefits, operators are now actively promoting this technology, where before many had been reluctant to do so.”

Truphone estimates that 87 per cent of mobile operators and device vendors plan to implement eSIM in the near term.

“Truphone is actively supporting many of these companies with our inhouse built eSIM technology,” says Alder.

“New device launches will continue to play a major role in the uptake. Many millions of new eSIM devices are being rolled out, with Samsung, Google and Microsoft being just some of the names that have joined the push to make this technology the standard. Nevertheless, mobile network operators don’t seem particularly bothered about migrating customers from plastic SIMs to eSIMs.”

Extreme Connect’s Farquhar suspects it is because eSIMs make it so much easier for users to change networks. “The eSIM revolution is here and changing networks is now as simple as downloading an app. Mobile networks have been reluctant to transition to eSIM because of the flexibility that it offers, in that users are not tied down.

“Now, with increasingly more barriers removed for switching, consumers are less likely to stay with their current network if they are unhappy.”

O’Prey agrees that the networks seem reluctant to get behind the eSIM revolution, adding that market dynamics are similar to the upheaval the music business went through when it transitioned from CDs and vinyl to downloads.

“The mobile industry is in the same state as when Spotify turned it digital,” he says.

“Record companies were dubious that digital downloads were a good thing. The same is true with mobile operators. They are not convinced about eSIMs. They are all on the GSMA Working Group that is defining standards, so they do support eSIMs but they just haven’t been pushing them to customers on an individual basis.

“Because the operators are not promotinge SIMs, consumers aren’t finding out about them other than reading about them elsewhere. Most people are not aware of eSIMS or their benefits.”

O’Prey says the networks are fearful of having to change their tried-and-tested systems.

“Offering a downloadable service requires them to modify their websites which entails quite a lot of work,” he says. “When you have a proven process for shipping plastic SIM cards, it is easier to continue that process. If you ask

Vodafone to switch you to an eSIM, it will post you a piece of paper with a QR code on it instead of emailing it to you.”

In a GSMA report on eSIMs sponsored by NetLync, Aboulhosn suggests that networks could offer try-before-you-buy services on SIM-only plans and for customers switching from rival operators.

This, he says, would effectively let customers test drive the network, assessing coverage in their homes or areas where they spend a lot of time. “This is especially important for prospective subscribers who may be considering switching from an established operator to an MVNO or newcomer with a relatively unproven track record,” he says.

As handsets become eSIM-only, networks will have no choice but to accept and embrace this new standard.